1863 Fort Wayne National Bank was chartered under The National Bank Act as the Fort Wayne National Bank

1863 Fort Wayne National Bank was chartered under The National Bank Act as the Fort Wayne National Bank HOME

Carl G. Santangelo and the Invisible Co-Trustee

1911 Key to the Numerical System of the American Bankers Association (pdf)

Sunniland

Contact

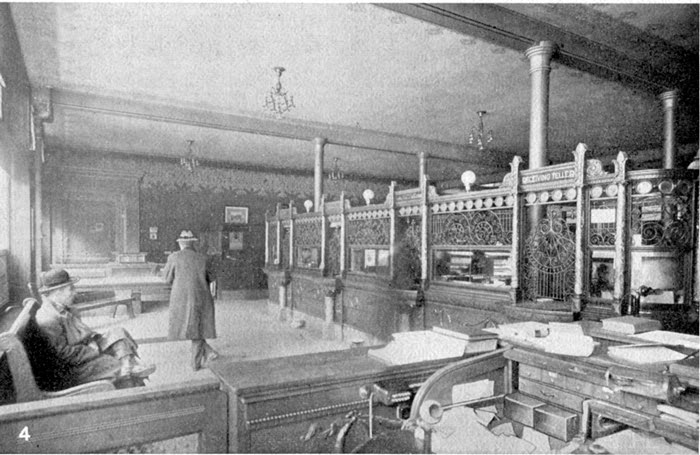

Fort Wayne's Formerly Largest, Most Powerful Bank, as Described in the Literature

FIRST AND TRI-STATE CORPORAT : 192823-098 Creation : 12/11/1929 Inactive : 01/01/1970

THE KRYDER COMPANY INC 193007-098 : Creation : 12/30/1932 to Expire: 50 years Inactive : 01/1/1970

Installments by Michele Picot-Strawberry

When the Frank Kryder Estate remaining 2/3 interest, that of Katherine and Rebecca, who is also, deceased along with her husbands and only spinster child, is returned to Katherine's per stirpes fold, an immediate endowment of huge proportions, bigger than any, will be granted in perpetuity to The Fred R. Reynolds Genealogical Library, and it will not be managed by Fort Wayne lawyers. Online is a Fort Wayne historical brochure published in 1924, Tri-State Loan & Trust Company: The Story of Its Growth and Development 1889-1924, stamped as accessioned on 2/11/1942.

What catches my eye first are the dates 1889-1924:

organization of STANDARD OIL COMPANY Legal Name: BP CORPORATION NORTH AMERICA INC.: 200 EAST RANDOLPH DR MC 2401A, CHICAGO, IL 60601: 182869-107 Creation : 6/18/1889 Other Names 4/23/1985 STANDARD OIL COMPANY 12/31/1998 AMOCO CORPORATION 5/1/2001 BP AMOCO CORPORATION

Which incorporation was accompanied by a flurry of 100-yr. gold bonds by key players, which makes 1989 very significant, when G.H. W. Bush was United States President.

4/14/1989 The Senate Banking Committee endorsed Pres. Bush's proposal for taxpayers to replenish the FDIC with a $90 billion dollar bail out plan, whole package to cost $157 billion over the next decade.In that period, the FDIC was not regulated by the Federal Reserve by RSSID Number.

Now keep this in mind for later down the page:

10/28/1933 Newly Chartered Fort Wayne National Bank; purchased "certain assets" of Old-First National Bank; affiliated banks of Old-First National were Mayer State Bank, S. Whitley, Old-First National Bluffton Branch, Churubusco Bank, Citizen's State Bank of Hartford City, First State Bank of Hoagland, the First Joint Stock Land Bank of Fort Wayne, and Farmers & Wabash National Bank, Wabash; Official figures for eleven months (January, 1922. to November 30. 1922) and an estimate for December shows that the Federal farm loan system supplied the farmers of the country during 1922 with upwards of $335,000,000 through the joint stock land banks.

$335,000,000: 2002 Gov. Jeb Bush Invested Florida State Pension Funds Lost to ENRON, which was financing Sunniland since at least 1964, of record. Wherever Fort Wayne makes a great gain, in time, there is an identical loss lurking in the future. It's so even!

President George W. Bush on July 30, 2008, bailed out Fannie Mae, sold to private interests by Pres. Lyndon B. Johnson, 1968.

The date of publication of the Tri-State Brochure also caught my eye, 1924, the year when it was decided all the Fort Wayne phone numbers would change, resulting in the 1927 Fort Wayne Red Book with its curious secret service "agencies" and phone numbers for certain bank vaults. Tri-State's vault was 5630. From the day Kay and Leonce Picot moved their family from Mr. McAfee's to their first home, down-paid by the former Mrs. Frank Kryder, Katherine's mother, until the move after the 1966, Kay's household phone number was -5630.

Thus, Tri-State Loan & Trust Company: The Story of Its Growth and Development 1889-1924 is a perfect insight into the impactful builders of Fort Wayne. From the Kryder's real estate deeds and other records, the directors of Tri-State Loan and Trust are familiars or relatives. George Pixley was intermarried into the family of Frank, Jr.'s first wife, Edith Ward Long. W.J. Vesey of Vesey and Vesey was the law firm which drafted and filed the Articles and Annual reports of The Kryder Company, Inc., 1931 until after 1950. R.J. Romy and his wife Bertha Romy were capitalists from Switzerland. Romys and Dislers (Minnie's father) were intermarried. Romy and Pixley incorporated The Indiana Investment Company in Lakeland, Florida in 1916, which accounts for Publix Headquarters presently being Lakeland, Florida in the same way that Kenan Oil, of Mary Lily Kenan Flagler, of Charlotte, North Carolina is in the current headquartered location of Bank of America (Shoaff-Barnett et al.) Frank Kryder, Sr. and Minnie built their house on St. Joe Boulevard in R.L. Romy's Subdivision of Hannah's Park Outlouts, Wayne Township, said Hannah also being a judge and grantee of The Union Pacific RR.

Pixley had started as a grocer, and with "Captain White," who founded White National Bank in Fort Wayne, both men were the county's most successful grocers. The first floor of 215 East Berry St. was once White's Fruit House. It is logical that the offices of Harley Somers, President of Farmers Trust Company kept offices on the second floow of the building, and when Somers left to run the Federal Farm Loan Bank in Louisville, KY, Clarence Frank Kryder moved into the same offices. Farmers Trust in Fort Wayne was organized to get capital to farmers, and did not fail, but evolved into Federally Guaranteed Farm Loans and the phasing out of the Joint Stock Land Banks.

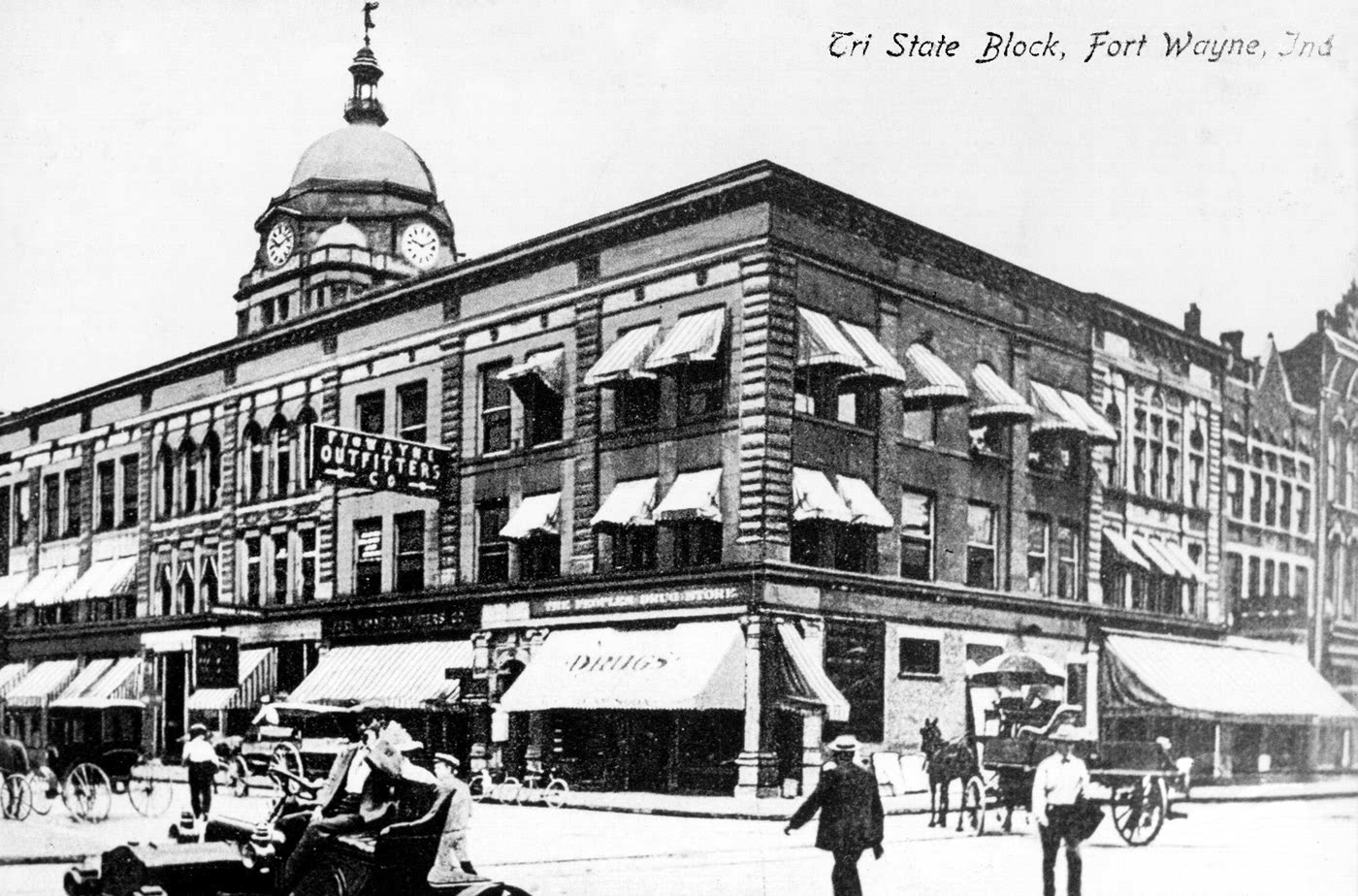

It cannot be said, "the farmers and bankers must be friends," in old Fort Wayne. They kept their capital separate, and farmers had to fight what big money already controlled- transportation and fuel, all which hurt the farmer, not the bankers. So Captain White and Geo. Pixley built solid banks of their own, then merged them as Tri-State Loan and Trust. It was the only balance of power in town. Though looked upon by the elite as "simple farmers" White and Pixley were rich farmers, courted by those who would take them down. Pixley, looking all of 90, is photographed with his shovel breaking ground for the new Lincoln Tower in 1930.

"Just 40 years after its construction, the Pixley-Long Building gave way to progress. Ground was broken for the Lincoln Tower just 30 days before the stock market crashed in 1929." Thus the appearance of Lincoln National Bank in the abstract- the land belonged Pixley at the end of the day and Lincoln Tower was unblemished, in fact thrived during the Great Depression, did not close in 1933, nor was Tri-State Loan and Trust ordered to close, but rather to "keep the change." And so it should be noted that the mighty Lincoln National Bank Tower, the greatest benefactor of Fort Wayne was foreclosed by American United Life Insurance Company in 1997, its mortgage 2 million in arrears. American United Life came into existence behind closed doors in Indiana in 1936 when two intertwined insuance funds were going to fail.

Long about the time The Indiana Investment Company formed in Lakeland, Florida in 1916, sales pitches for Florida Land were flooding national newspaper classifieds. True knowledge of Florida's soils and weather was not yet known. To this day, it is by virtue of its natural geology and geography, wholly unsuited for agriculture other than particular landscape trees and shrubs, excluding sod.

You will read that Tri-State Loan and Trust, really a mutual fund, by its own description, was dedicated to making residential mortgage loans at attainable rates. High Society in Fort Wayne was never interested in investing in working wage priced housing- but they needed houses for workers in their factories. But everything great thing was done with other peoples' money. Industry did not want responsibility for those needed to make wealth possible. And so it was prosperous gentleman farmers, men with produce, railroad gold bonds and land who the Tower People lured into becoming builders and developers of a model city, prosperous, homes for all, and a park/square mile, putting up their own money to do it. Aesthetics were as important as economy.

There is a false narrative of the Fort Wayne bank collapses, before the FDIC, propagated by the Ellinghams, who owned the Journal Gazette, who married a Bond, who married a Rosemary Kryder, Frank's daughter from his second short marriage, who was born (1924) seven years before Katherine (1931) was born into Frank's third marriage. The author is Scott M. Bushnell, Hard News: Heartfelt Options, a History of the Fort Wayne Journal Gazette. The description of the bank reorganization in Fort Wayne does not agree with archived history, as corrected and authenticated for Charles H. Halter, lawyer, by Walter P. Helmke, lawyer, in 1979 in a Canal Lands Abstract, #201245. The book is Fort Wayne style propaganda as has been disseminated there since the 1924 days of the KKK Indiana governor, at least. The true part of Bushnell's vague account which heroizes Fort Wayne National Bank, is that only Lincoln National Bank (Barnett) and Peoples Trust and Savings "avoided "re-organization in 1928 when the Comptroller came to town. First remember that the Journal Gazette is blocked from every online newspaper archive after1923, until a very present archive. Therefore, you would have to travel to Fort Wayne and spend several years in the Fred R. Reynolds Library, where Genealogy and History Reign, reading microfilms to get a true picture of Fort Wayne 1917-1991. Who is going to do that and why?

Most likely it is going to be the Kryder granddaughter born 12/17/1953, on the birthday of RAYTHEON, who never found the purpose for her wits. This is the RAYTHEON which was in Fort Wayne until its present incarnation which I wonder is related to the Harris Bank which took over AMCORE. The hisotry has already become very muddy, with no mention of Fort Wayne, Indiana associated with Fort Wayne , Indiana, though it was the darling of Lincoln National Life Insurance and Howard Hughes' Benfeciary in a 'round about way.

RAYTHEON COMPANY : 141 Spring St. , LEXINGTON, MA 02173 : 1988042035 Active : 04/04/-=1988 Inactive : Original Creation : 12/17/1953 Original Creation State: DE Other Names 04/04/1988 RAYTHEON SYSTEMS COMPANY 02/08/1996 HUGHES AIRCRAFT COMPANY 02/11/1998 HE HOLDINGS, INC.

To keep the record straight, as it is very hard to find at present, "In 1925, the year American Appliance Company began to take off, an Indiana company made it known that it held prior claim to the American Appliance Company name. Because of the success of the Raytheon radio tube, company officials at that time elected to extend the use of the name to describe the entire organization, and the company's name was officially changed to Raytheon Manufacturing Company. "Ray" comes from "rai," an Old French word that means "a beam of light," while "theon" comes from the Greek and means "from the gods." "

Also consider the CIA file which is findable,

| Howard Hughes | Miami, Florida | HHMI/Raytheon (Ft. Wayne)12/17/1953 |

Despite the intrigue, the story is too digressive for here, but it is so Howard Hughes he was creating his Foundation in Miami, 45 minutes from where and when I was being born...

Fort Wayne had "marked" Katherine the minute she was taken to Florida in 1941, tagging her because of her father's National Oil leases which would end up a secret asset of Zapata Oil, using Moser and Jones and Mr. McAfee's house where Kay and her daughter first lived. They could not account for the genetic outcome which would one day activate and drive the relevant Kryder kin to find their secret vault.

To "see" the Tri-State takes many years of searching just to know why it is that which must be sought. It is by Nature cloaked and by historical distortions incomprehensible, not to mention few are they who are driven to undertake it fr any reason. This mystical draw of the mighty bank which holds the key to many others but keeps itself hidden could be under the pall left over from the Masonic Temples, where all great deals were made amongst the men. Architects who were Masons of the 33rd Degree, like Wing and Mahurin, were the architects of the fka The Standard Building nka The Elektron Building of lawyers at 215-217 E. Berry Street. Every great man of business was recruited into a Lodge, Brotherhood, or Scottish Rite in Fort Wayne- belonging was a reference to assure the public they were dealing with the town's most noble-minded men.

The details of Treasury Cause 3285 in Fort Wayne were included in this particular Canal Lands Abstract (1824-1979). It is written out in a section which concerned some Native patents, elaborated in the Abstract pages covering the twenties and thirties, concerning a parcel being mined for limestone by one of those initals only contractors, like D & S, Inc.

It remains to be seen why a basic accounting of the Comptroller's Bank Consolidation was put into an Abstract of Title. By 1927, Fort Wayne had a national bank on every corner with interlocking directorates of the town's capitalists, landowners, leading merchants and industrialists. All had sprung from the Forehead of McCulloch who sought to keep the Bonds and Flemings at the top with his idea of sub-national branch banking. Without the Bass Foundry, Berghoff Brewery, Fort Wayne Knitting Mills, International T & E, an electric comoany, a telephone company, wheat, bricks, lumber, oil, and limestone there would have been no top, no one to spawn more McCulloch banks. McCulloch was a member of London's 1868 Corporation of Foreign Bondholders along with Robert Fleming and Fried.Krupp.

Contrary to the Ellingham's account, The Consolidation as described in the Abstract had Old National as the insolvent bank, with about $11,014,361. It was ordered closed in 1928.

Tri-State Loan and Trust Company, Inc. had the most resources and was holding "$25, 633,809.

First National Bank had assets of $19,985,775 and $2,474,533 owed from banks.

(Where did First National come from, and where was the 1865 Fort Wayne National? )

.continued...

Here is conflicting information I have from books and news before I found the Abstract:

1. 6/24/1931 First and Tri-State Bank and Old National Bank(71-19) were

merged with assets of more than $36,000,000. FALSE

(As which bank?) Neither bank existed in 1931.

First and Tri-State Bank merged with White National Bank prior to 1911 to form Tri-State Loan and Trust Company (71-24)

2. First and Tri-State National

Bank and Trust was chartered as First

National Bank. FALSE

The

National Banking Act of 1863 (Amendments in 1864 and 1865) was passed;

First National

Bank of Indiana was the eleventh in the United States organized under the new

laws.Only Somewhat TRUE, yet for the most part CONFUSED

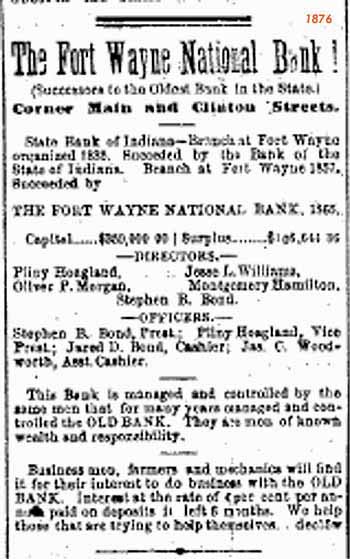

TRUE: Fort Wayne National Bank , no. 11, was chartered in 5/22/1863, Charter signed by Hugh McCulloch, 1863 under The National Bank Act as the Fort Wayne National Bank ; opened 7/1/1863

The complete history is:

1835 "Bank of the State of Indiana" was chartered; Hugh McCulloch was cashier and manager of the Branch at Fort Wayne, aka the beginning of Fort Wayne National Bank

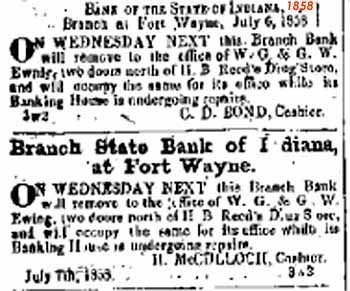

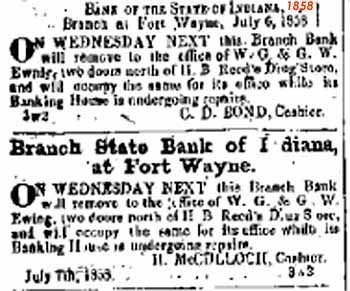

1858 "Bank of the State of Indiana Branch at Fort Wayne, July 6, 1855, On Wednesday next this Branch Bank will remove to the office of W.G. & G.W. Ewing, two doors north of... Reed's Drug Store and will occupy the same for its office while the Banking House is undergoing repairs. C.D. Bond, cashier."

1863 Fort Wayne National Bank was chartered under The National Bank Act as the Fort Wayne National Bank

1863 Fort Wayne National Bank was chartered under The National Bank Act as the Fort Wayne National Bank

National City Bank of Kentucky 101 South Fifth Street Louisville, KY 40232 Established: 1/1/1863

1865 Organized January 1865- Fort Wayne National Bank 1/01/1865

3/07/ 1865, Hugh McCulloch, president of the State Bank of Indiana, entered President Lincoln's cabinet as secretary of the Treasury succeeding Salmon P. Chase.

04/14/1865 Pres. Abraham Lincoln was assassinated in Washington, DC.

04/15/1865 Hugh McCulloch divided the focus of the Secret Service from the Treasury to Treasury + Presidential Security. He then returned to the bank at Fort Wayne.

05/15/1865 John P. Usher of Indiana left Lincoln's cabinet and became consulting attorney for the Union Pacific Railroad.

(Originally, Fort Wayne National Bank began in 1863 as "The First State Bank of Fort Wayne Branch No. 11"; Organized January 1865- Fort Wayne National Bank; 03/07/1865, Hugh McCulloch, president of the State Bank of Indiana, entered President Lincoln's cabinet as secretary of the Treasury, succeeding Salmon P. Chase; August 1865 Fort Wayne National Bank succeeded the First State Bank of Indiana.

In 1858, the father of American Banking moved the original Bank of the State of Indiana Branch at Fort Wayne to the offices of the Ewing Brothers, W.G. & G.W., notorious Native Patent swindlers. The Indian Agent in Allen County, John Tipton, wrote several times to The Indianapolis Star which published his complaints, as Agent, concerning the swindling of land as well as disenfranchisng Natives of their voting rights with threats. He wrote to the Great White Father many times over about rabble rousers who gave forbidden whiskey and rifles to young braves, the Ewing Brothers, and what was needed in rations.

Fort Wayne courts and trust companies supported its Ewings who traveled the state gathering Patents and acreage for (Hamilton National Bank 71-20) Allen Hamilton's Box of Evil. That is where he hoarded patents in a four-digit numbered box which number in 1934 became an FDIC certificate number for Northwest Bank.

5/6/1902 The charter of First National Bank 71-21 (Fort Wayne National 71-21) was extended for another 20 years

6/13/1903 Tri-State Loan and Trust Company 71-24; acquired Fort Wayne Trust Company in 1906.

(1917 Hamilton National Bank 71-20, Cedarville, (Charles McCulloch president) merged with First National Bank 71-21 in Fort Wayne; )

The end of the begining of the FWNB journey was through National

City Bank Established: 1/1/1863

eventually merged (1998 PNC).

The Federal Farm Loan Bank was headquartered in Louisville, KY where Harley Somers, once secretary of Farmers Trust, Fort Wayne, issued Farm Loan Bonds taxable at death. Clarence Frank and Minnie Kryder formed a National Farm Loan Association in 1933 with John Burns, author of Indiana Corporation Law, of that day and time, along with prosperous associates from Blackford County (Hartford City). This event is recorded forever with 103 acres of Waynedale Gardens 2nd. Addition on the day HOLC Bonds were first issued. Clarence was Trustee of the Association, but the bonds were registered to Clarence Frank and Minnie V. Kryder as the original Grantors of the land. It is not so complicated in that case for the Comptroller to go to the first day of HOLC Bond sales to find the Kryders and WHO paid the death tax for Waynedale 2 & 3 in 1976. That was the unconditional guarantee of the Treasury to registered owners- the low yield HOLC was the safest investment available.

Clarence Frank Kryder took over Somers offices in the Standard Building Fort Wayne when Farmers Trust closed. The President of Farmers Trust was D.W. McMillen. aforetime President of Central Sugar (beet) before becoming President of Central Soya as well as a director of the later bank with Maxfield (NAVL).

Clarence Frank Kryder took over Somers offices in the Standard Building Fort Wayne when Farmers Trust closed. The President of Farmers Trust was D.W. McMillen. aforetime President of Central Sugar (beet) before becoming President of Central Soya as well as a director of the later bank with Maxfield (NAVL).

"First National" in Fort Wayne was the Barnett's spin-off precursor which migrated to Florida, branched, and then had to be taken over by Barnett Bank of Florida, after the crash. A few decades handed them Southeast Bank of Florida (as the transition was made from Barnett to Bank of America). First National (ABA 71-21) in Fort Wayne operated under the charter of Fort Wayne National Bank. The two never existed at the same time in Allen County, and Fort Wayne National Bank (ABA 71-21) changed back to its original name with a new charter, after the crash

3. First

National Bank (71-21) was called First and Tri-State Bank which upon consolidation with Tri-State Loan and Trust Company (71-24) merged into Old National Bank (71-19); FALSE

According to the Abstract and Moody's, this merger never happened. Earlier, Tri-State National Bank merged with White National Bank (Grocers Pixley and White), before 1911, to form Tri State Loan and Trust Company, not to be confused with First and Tri-State Corporation.

*

Wherefore, with these small corrections to the myth, the Comptroller's accounting written in the 1979 Abstract, we will see the more sinister aspect of Allen County predatory banking and find the original "$33,400,000" of " realty assets acquired with the founding of Fort Wayne National Corporation in 1982, a multi-bank holding company, an amount hidden in the Depression in 1930 which has been rolling along eternally, its own invisible branched bank. We can reason how Katherine's Kryder's husband, Leonce Picot, was lured into laundering a fortune on the Maxfield Plan. We will also see the relationship of The Fort Wayne Rolling Millions to the growth of megabanks through bank failures. We can establish organized criminal racketeering for the benefit of high elected officials, even traitors, who favor themselves and their financial tyrants. We will see that the cycle of bank failures and enormous government bailouts given to the FDIC were not accidental, unrelated climaxes to runs of bad luck, but timed. How compromised is the integrity of our Treasury when Insiders annulled a 100% unconditional guarantee for the safety of its government instrumentalities, and put it to their own uses- destructive uses, nothing the registered owners ever had in mind?

After changing Lincoln's objective for the Secret Service, obviously they felt no need to keep up with McCulloch's organization for a few decades- who could be straighter then the father of American Banking?

Before I fill in the defining numbers, straight from a Treasury Cause few people alive have seen or ever thought about, or would relate to, one which has defined the integrity of our banking system and its regulation we have been trying to make an honest woman of since 1934, supposedly, I will sum up the significance of the Consolidation.

Hugh McCulloch and his desendants built a multi-national bank holding company with industry and capitalists, and railroad magnates, naturally "fixing" about every contract in the county and deals with the state since 1858 or earlier. In 1904 banks became allowed to accept railroad mortgage bonds to count as deposits. In Fort Wayne, banks were ruled by Robert Fleming via The Norfolk & Western Ry and its cohorts, The Pennsylvania RR, The Wabash, and The Nickelplate. By World War II the men behind the curtain had reached their goal, set forever- Fort Wayne hosts the established government defense contractor for the only electonic defense technology of its kind.

Though by the end of World War I, the banks in Allen County had changed some names, merged, and were all cross invested in each other and their directors. Only an entity for "TRI-STATE CORPORATION" exists in the Secretary's File. It owned the Loan and Trust, but other things too, such as land. TRI-STATE CORPORATION, "too far from the arm of federal law,"in the words of John Tipton, Indian Agent, was the umbrella for all the risk, and when you understand its succession of directors and what was happening in everyday Fort Wayne, it looks very much like the collapse meant Bonds, Barnetts, and Flemings selectively pulling the rug out from beneath the banks of the captains of industry and groceries, the producers, so that Fort Wayne Bank, the plunderers, could emerge the winner and bully the rest as needed. They legislated vigoroursly until Amendments of the Bank Holding Company Act took effect in 1969. Though the amendments allowed one bank to own others, banks were never allowed to own businesses or non-bank related corporations. Certain companies studied in connection with Kryder did it anyway, 1934-1969, chipping away at the sensible law specifically written after a disaster, to protect future America from another financial disaster. Banks gradually became allowed to own travel agencies, bank real estate, and lease companies for the equipment and appurtenances of a bank. 1968-1970 litigation.

Considering the time period, mid-sixties to 1970, "Multi-Bank Holding Act" were not exactly household words, and as a nation battered with assassination, war, riots, psychedelics on every college campus, subterfuge, and more, we were whisked from the safe and orderly society we were taught was The United States while in elementary school, the nation of Centerville. The adults were cocktail partying and starting to swing. The change wasn't fair, I thought. No one was in control. It didn't seem to be about the banking system, but about wild behavior, the violence-promoting Establishment, or drugs. After the sixties decade of national psychological terror, bank holding laws seemed of low priority to a public who didn't really understand what they were, from whence they came and why. Nor were they intended to understand. The more ignorance maintained about bankers and banking, the more they grab, easily able to afford the fine.

Gradually pushing the Bank Holding Act as Amended deep into antiquity, at first, banks were allowed to form one-bank holding companies of themselves. Lawyers pushed for mutli-bank holding in banking law, in lieu of private business stock holding, and won. Who knew?

Nevertheless, the Banking Holding Amendments had always required that only a chartered bank could become a bank holding company, the original holding company for Lincoln National Bank, Lincoln Tower Corp, Fort Wayne, was "Satisfactory Finance Company" which promptly changed its name to Tower Bank and Trust. Then,

12/24/1968 Lincoln Holding Corporation, Inc. Articles of Organization

12/24/1968 NORWEST INDIANA, INC.: 111 E. Wayne St., FORT WAYNE, IN 46802 : Control Number: 196812-420 Status: Merged Creation Date 12/24/1968 Inactive Date: 12/22/1997 Other Names 9/3/1993 LINCOLN FINANCIAL CORPORATION Former

7/10/1969 Lincoln Holding changed to Lincoln Tower Corp.

F.R. 1970-12-08 12/08/1970 Lincoln Tower Corp acquired "Satisfactory Finance Corp" and changed name to "Tower Acceptance Corp"

1970-12-08 (Texas/Murchison) TOWER ACCEPTANCE CORPORATION located at FORT WAYNE, IN was established as a Finance Company.

1973-12-31 TOWER FINANCE AND ACCEPTANCE CORPORATION was renamed to TFAC, INC..

F.R. 2014-04-26 TOWER BANK & TRUST COMPANY was acquired by OLD NATIONAL BANK.

F.R. 2014-04-26 TOWER BANK & TRUST COMPANY was renamed to FORT WAYNE BR and became a branch of OLD NATIONAL BANK

"It's their way," said Hazel Gerdardot, from New Haven.

Now I will sum up the short version of the Abstract of Title Account of the Bank Consolidations in Fort Wayne, Indiana, in 1928 by the United States Comptroller of the Treasury.

In thirty years I have come to understand the 20th Century as it connects to now, but that is not evidence. We have had the power to free ourselves all along, like Ruby Slippers, with the Numerical System. The System was made for a good purpose, to control bad bankers. It is there for regulatory agents and agencies. Systematic Numbers are not questionable. But they have to be seen to ring the bell. That the Numerical System has been perverted in the transfer of wealth is all the more reason for the bad-intentioned to keep the public in the dark.

September 15, 2023: Commemorating 51 years after the death of Katherine Kryder, Fort Lauderdale, FL and the simultaneous birth of Lincoln Financial Corporation, Cuyahoga, OH TREASURY CAUSE 3285 Consolidation by Comptroller Order 344, 1928, Fort Wayne, Indiana Presented to pinpoint the origin of $33,400,000 in assets other than cash appearing in the 1982 foundation of Fort Wayne National Corporation, considering the origin of the concept, as connected to the London Counting Houses of Robert Fleming and the ages past. Also presented to introduce the K.W. Maxfield $8M, $6M, $2M Loan Capital Scheme, offered to Leonce Picot, a man profiled as long given in to temptation, for the Fort Launderdale maneuver, 1974-2018. * To begin we know we are working with people bred from the highest class of money jugglers in the world. Over fifty years or so, it is seen in their endeavors certain amounts tend to follow them around like pets, though the 000s have increased past comprehension. Which makes the 1928 Consolidation a perfect study of their way. The numbers aren't too large, and by applying the 1911 Banker's Key we get an idea how easily the public is made confused, treated like babies, by the explanations we and our descendants are left with following human-induced disaster. In the Abstract are stated the total assets of Tri-State Loan and Trust Company (71-24), First National Bank (71-21), TOTAL ASSETS ON THE CONSOLIDATION TABLE (71-21) First National Bank $22,206,308 this in its Consolidated Fort Wayne Form became The notes in the abstract indicate First National ceased to exist (under the former Charter of the previous Fort Wayne National Bank, dba First National Bank). So, as accounted in a Canal Lands Certified Abstract of Title which is the best we can get without cooperation from the Treasury Archives, it awkwardly appears quite a bit of money went off the books in this consolidation, when seen in the same place, on the same page. Names subtly changed as Fort Wayne battled gangsters, Shantytown, labor strikes, and an upper class concerned primarily with itself and the distant rumblings of war in Europe, something for which Fort Wayne Radio and Industry was amply supplied and chomping at the bit to sell to the U.S, government. There are several interesting ways to Account for all the assets of Consolidation 344, based on what these banks were jointly holding or claiming. The everyday public had no reason to question the bank directors who were lauded everywhere for their greatness and achievement. Their portraits, monuments, institutions and buildings doused every nook and cranny. Most of the town and country folk were not actually aware that the great things the men of the banks had done for Fort Wayne, were done with other people's money, not quite freely offered. Who was going to FOIA Treasury Records of the Fort Wayne Bank Consolidations, or scrutinize Moody's, for why? Those in the real estate, insurance, investment and finance business were not free to call foul on the Pillars of the Community, Fort Wayne's greatest Benefactors. Resistant men had to find their allies and quietly go their way in small associations and endure it, or build no legacy at all. When Indian Agent John Tipton wrote President Washington, "Fort Wayne will never be a safe place for families," that was prophecy. Married to the daughter of Little Turtle and in frequent correspondence with the Great White Father, who invited Little Turtle to the Whitehouse to sit for a portrait which was later burned, Tipton is a reliable witness. The clearest, yet most curious accounting is also the simplest. For this we need a Table within a Table, in keeping with the nature of a RICO, to layout the re-distribution of the three banks born of The Father of American Banking, Hugh McCulloch, who had entangled their finances to baffle and defy regulatory scrutiny. This makes "The 1927 Fort Wayne, Indiana Red Book" so fascinating. In 1924 it was decided Fort Wayne telephone numbers would be changed, thus the slim red paperback directory with ads, business numbers, residential numbers by name and by street intersections came into being with its curious Preface to not give your copy of The Red Book away, if you had one.That is how I discovered there were four secret service "agencies" providing service in Fort Wayne in 1927, one stationed in the Standard/Elektron Building, where the Kryder Offices were, and two in the First National soon to be Fort Wayne National Bank Building. Principals were O'Neill, Leo Alexander, Philpott, and Abbott.

Then let's review history for a moment, outside the box, concerning the advance future movements of those who had unquestioned access to the Frank Kryder Family, full knowledge of their property and family schisms.

|

...One way Fort Wayne has buried its financial history is to rip out whole streets of the former banking district, such as Calhoun Street and The Tri-State Block, and reshape the landscape into something utterly different, as was undertaken in 1969 with the erection of the new present day former Fort Wayne National Bank Tower and Freimann Park. Old National, People's Trust and Savings, a family owned bank, and other influential pinnacles of downtown business have been razed.

1884 Fort

Wayne National Bank changed its name to Old

National Bank; Old National Bank (chartered in 1863 ) was the Fort Wayne correspondent of the Pennsylvania Company. In 1922, Kryder's First Addition to the Town of Fort Wayne was replatted over W.H. Simons Addition, save one Lot, called W.H Simons Addition, so that Simons history will never completely disappear from Allen County, nor the Kryder

Fort Wayne's Old National Bank 71-19 of the ABA Numerical System, was Ordered Closed in 1928 in Treasury Cause 3285 by Comptroller's Order 344. Stated in 1930's Moody's as liquidated, in 1982 Frank Kryder's federal taxation lawyer deposited a dangling Frank Kryder asset in the paltry Trust Bordner maintained for Frank's widow, from Lincoln National Bank, through Fort Wayne National Bank, which re-stamped it pay to Old National Bank 71-19. The asset originated from a larger account 5000 350511 in Peoples Trust and Savings which had been the Trustee of The Original Plat of Waynedale, 93 lots in which the Kryder Company had an undivided interest.

The Superior Court Document 5789 is the same last four digits of Thomas Gordon Moorhead's SSN. T.G. migrated to Fort Wayne from Canada and was Frank's lawyer in the twenties. His son, Thomas M. Moorhead, was Minnie V. Kryder's estate lawyer as well as vice-president of The Kryder Company, Inc. The taxpayer number for Union Trust is ****5789. The massive Southeast Bank of Florida failure, after which NAVL and Clayton, Dubilier, Rice came out smelling like roses was scarcely covered by its FDIC Certificate Number 5879

Old National Bank 71-19 was Ordered Closed in Treasury Cause 3285. Hugh McCulloch, sometimes revered as "the father of American Banking,"came directly back to Fort Wayne from his position of Secretary of the Treasury after Lincoln was assassinated, to run the Fort Wayne National Bank with the Bond and Fleming families. Barnett was married into the former German American National Bank, powered by Berghoff Beer which changed its name to Lincoln National Bank. President Lincoln had Treasury problems, not just with policy brought on by the War, but counterfeiting was rampant, with no way for the Treasury to get a grip. Thus, the Secret Service was signed into law by Honest Abe, to protect the integrity of the U.S. Treasury. Lincoln was promptly assassinated and the next day Hugh McCulloch changed the objective of The Secret Service less to involvement with Treasury matters, and more to protecting the life of the United States President. The significance being that since the Lincoln Administration Treasury, the Bonds, Barnetts, Flemings, and McCullochs were privvy to all the techniques and possessed the artists, equipment, and materials to print their own bank notes, with the blessing of the Treasury.

|

pdf in historical newspapers: 1876 Fort Wayne Banks (FW NT'l name in use) 1884 Robert Fleming/Oregonian Ry Panic 1885 Old National Bank History and Directors 1911 Key to the Numerical System of the American Bankers Association 1913 NEW YORK DRAFTS FLEMING.; Indiana State Senator to Manage $33,000,000 Corporation Here. Special to The New York Times. (); April 29, 1913, , Section , Page 1, Column , words 4/29/1913 to work for Morgan interests and a big fertilizer company. 1919 Straus/Commercial Bank of Basle Correspondent/Lincoln Trust 1920 Frank H. Kryder saves attorney Thomas G. Moorhead's Life: Headline "Attorney Badly Mauled" 1921 Bank Officers "Banks Hold Their Annual Elections" third col from right Citizens Trust Fort Wayne 71-23

|

Tri-State National Bank

Fort Wayne, Indiana

continued

Notes

Night of the Batistas- save this for later Fort Launderdale

Onassis was pro-axis, the FBI was informed. He was denied the privilege of purchasing U.S. war ships sold by the government in 1947. He constructed a "silent American" association to acquire a fleet of tankers, including S.D. Bechtel and John McCone, who when interviewed claimed "no knowledge" of Onassis being involved. Financing was attributed to Onassis, National City Bank and Metropolitan Life. Several areas of the file indicate criminal indictments are needed but one or two critical parties (censored) can not be called to testify. Thus the American portion of the suit was reduced to civil judgements. Onassis received 6 criminal convictions, forfeited 17 ships, $7,000,000, and $160,000 in fines. Onassis paid $1,000,000 at the time, with $6,000,000 guaranteed by National City Bank, to be paid to the government by 1959. (FBI File)

| 11/21/1998 | Merger or Purchase & Assumption | NATIONAL CITY BANK OF INDIANA | 362445 | FORT WAYNE NATIONAL BANK transferred its assets to one or more institutions including NATIONAL CITY BANK OF INDIANA. FORT WAYNE NATIONAL BANK ceased to exist as a head office. |

1934 (71-21) Fort Wayne Bank new Charter; starts over with

$6,000,000 capital

$2,000,000 RFC Loan

totalling $8,000,000

(Moody's) June

1964- North American Van Lines (K.W. Maxfield) obtained a bank loan of $8,000,000 maximum

credit, $2,000,000 of which was a term loan repayable $400,000 annually for five

years, the other $6,000,000 a credit loan available as needed. Unlike other loan descriptions in Moody's, no interest was stated. Maxfield was a director of the Fort Wayne National Bank (Holding Company).