HOME PAGE

contact Michele Picot

Numidence and Indiana Jones for Loans

NUMIDENCE

DEFINITIONS AND DERIVATIONS

Numidence I have derived from the word NUMIDENT which is not in Webster's.

Numident is a term of the Social Security Administration:

(NUMIDENT), created, 1936 - 2007, documenting the period 1936 - 2007

Creator: Federal Security Agency. Social Security Board. 7/1/1939-7/16/1946

(Predecessor) Social Security Administration. 3/31/1955- (Most Recent)

The NARA has the currently available SSA online searchable NUMIDENT Files

"A NUMIDENT record may contain more than one entry. Information contained in NUMIDENT records includes: each applicant's full name, SSN, date of birth, place of birth, citizenship, sex, father's name, mother's maiden name, and race/ethnic description (optional). NUMIDENT includes information regarding any subsequent changes made to the applicant's record, including name changes and life or death claims. "

A NUMIDENT record in itself can fill in many gaps in research.

In Treasury-related cold-cases then, Numidence is a de facto id; an original Individual's Application for Taxpayer Identification Number, which may become prima facie evidence in a RICO.

The SSA App will have the applicant's signature and other data which has to fit what is a suspect concocted scenario.

Any data which can be added to a prosecutabe RICO due to its long time absence from Social Security Administration Records because it was adversely or illegally withheld for long after-death redemption of Death Tax securities can be called NUMIDENCE.

NUMIDENT Files as found through the NARA are only sheets of data. To obtain de facto i.d.s and documents, the FOIA procedure must be followed through the Social Security Administration. However, until now, SSA was not able to access information which should have been as handy as any other ordinary Application for Taxpayer ID. Numbers were not in the Master Death File where they should have been.

The concern is Securities Trading leveraged by illegally retained federal securities which were not redemmed and taxed at the death of the registered owner.

Not all the War Bonds or New Deal government instrumentalities or even Savings Bonds were exchangeable for "like" instruments such as Treasury Notes.

These investments ceased earning at a point. If they were passed from the original owners through a generation skipping transfer, a trust company concealing them from heirs was only safe for a certain number of carefully amortized years before the U.S. Comptroller might wonder why groups of Liberty Bonds, for example, had never been redeemed.

Or, a trust company concealing Treasury Notes converted as a group through time eventually has to place that low yielding government investment into commerce and launder it.

Taxpayers who of record were Registered Owners of U.S. Securities whose Taxpayer numbers should have been but were not in a timely fashion entered into the Social Security Master Death Index may become those dead men which actually do tell the greatest tales of all.

Some History of En-Ar-Co Illustrated

William Eugene or Gene Moser, in Bluffton, Wells County, IN was a partner with Roy C. Jones, Jr.

Mr. Moser owned National Oil and Gas until the year of Leonce Picot's death, 2018, filing an annual report on the date of Edgerton's death to affirm Moser was still CO of his heavy transport company when Edgerton expired.

M & J LANDS INC 221719 FEI/EIN Number 59-1003643 Date Filed 03/23/1959 State FL INACTIVE VOLUNTARY DISSOLUTION10/06/2003 552 FOREST TRAIL OVIEDO, FL 32765 Changed: 02/20/2002 JONES, JR., ROY C 552 FOREST TRAIL OVIEDO, FL 32765 PD MOSER, WILLIAM EUGENE P.O BOX 476 BLUFFTON, IN 46714 Title STD JONES, ROY C JR 552 FOREST TRAIL OVIEDO, FL 32765

In 1950, William Moser was President of Moser-Hathaway, in Polk's City Directory, Fort Wayne. They were distributors of Gulf Refining Company Products.

VP was Joe F. Sherron

Sec.-Treas. was Morton M. Hathaway.

The 1950 Plat of Wells County Indicates a small Petroleum field about mid-county.

In 1958 William Moser was President of National Petroleum, Bluffton, IN. He was Married to Emma Meyer Moser.

In 1958, Roy C. Jones, William G. Moser, Leonce Picot, Bob Thornton, and Jack Thornton made several overlapping trips to Cuba.

Florida Profit Corporation NATIONAL PETROLEUM LEASE CORPORATION Document Number 222349 Filed 04/09/1959 State FL DISSOLVED 06/07/1966 Jones and Moser

GULF PIPELINE COMPANY Document Number 813293 FEI/EIN Number 25-1043617 01/02/1959 State DE Status INACTIVE Last Event MERGER 07/26/1985 Address 1301 MCKINNEY P O BOX 2227

What do we have here but another *3617 to go into our Numidence series as a match for Edgecot *3617 !

JONES FOR LOANS INC PO BOX 32018 LAKELAND, FLORIDA 33802

INDIANA GOT TO KATHERINE KRYDER'S LEGACY THROUGH ROY C. JONES, JONES FOR LOANS, AND WILLIAM EUGENE (GENE) MOSER OF BLUFFTON, WELLS COUNTY , IN.

Roy C. Jones got to the fatherless 19- year old Leonce Picot through First Presbyterian Church, Downtown, Fort Lauderdale. At 21 years old, Jones took him to Havana where there were 11,500 prostitutes.

My Beautiful Mother never stood a chance, and I was doomed before I was born, doomed to tell a story I can barely stand to live. Those bastards!

My Beautiful Mother never stood a chance, and I was doomed before I was born, doomed to tell a story I can barely stand to live. Those bastards!

Katherine Kryder was Pure.

MEYER

William Moser, the Bluffton, Indiana Oil distributor part of Indiana Jones for Loans married Emma Meyer.

12/24/1940 National Oil & Gas Inc BRANCH Company Number 0849954 Status Active Incorporation Date 24 December 1940 (over 81 years ago) Foreign Corporation Jurisdiction Kentucky (US) Branch of NATIONAL OIL & GAS INC (Indiana (US)Agent National Registered Agents, Inc Agent Address 306 West Main St., Suite 512, Frankfort, KY, 40601 Directors / Officers National Registered Agents, Inc, agent Timothy L Drayer, director Timothy L Drayer, treasurer Trout T Moser, director Trout T Moser, president

*

The Gulf Oil Corporation was formed in 1907, mainly an enterprise of the Pittsburgh Mellons which is logical since Fort Wayne National Bank eventually merged into PNC.

What defies logic is that my grandmother, the third Mrs. Frank H. Kryder was born in 1907. I named her "BUNNY" as soon as I could speak, and the name stuck permanently.

*

Roy C. Jones served 59 years as a deacon, steward, trustee and usher of the First Presbyterian Church of Fort Lauderdale. It must have been there he came into contact with Leonce Picot who attended the downtown church regularly in his youth and was at sometime after the age of 8 baptized there.

*

Michele Picot-Strawberry

God Our Marker Doth Provide

"National Oil Indiana held title to land in Cedarville from 1948-1978. "

I found that fact some years after I had been on my first trip to Fort Wayne. Not only was I propelled to Fort Wayne in 1993 by remarkable events, I wasn't sure what to do once there. At the time, I wasn't even sure what a County Assessor's Office might have for me, but I had a historical Plat of Clarence Frank and Minnie V's land in Cedarville, Allen County, so I asked for the Big Plat.The first platted land on paper I saw in Fort Wayne was National Oil's acreage abutting the former Kryder land on Cedar Creek, outside of Fort Wayne.

Not even knowing about oil and gas, I was surprised to see oil drilling in Indiana. Was National Oil related to the Kryders? Frank, Jr. worked for National Construction, 1954.

Why did the re-created Raytheon and the pre-created Howard Hughes Foundation (HHMI) coincide with my 12/17/1953 D.O.B.?

Why was there a 1948 Raytheon? RAYTHEON COMPANY Officers 141 SPRING ST LEXINGTON, MA 02421 Jurisdiction H858850 WITHDRAWN (FOREIGN) 12/01/1948 (see 12/02/1948 below) 04/28/1998 DELAWARE Agent CT CORPORATION SYSTEM 1201 PEACHTREE ST NE ATLANTA, GA 30361 FULTON

Research with the U.S. Comptroller and the recorded HOLC Bonds securing Waynedale Gardens, registered to Clarence and Minnie Kryder gave me the idea that since Frank, Jr. has no paperwork at death in Allen County, at some point the "Death Tax" or "Redemption Tax" would have had to been paid by the senior Kryders. Notice of Death goes to SSA. Taxable at death securities presented to the Comptroller for redemption triggers a notice to IRS of tax due. If it is death tax, SSA is the only one who knows for sure if a taxpayer has expired, supposedly. Sometimes, as in aka Kay Picot's case no one bothers to file a death certificate and their SSN lives on and on, until a Numident Sweep, intended to sort out anomalous numbers of the living from the dead.

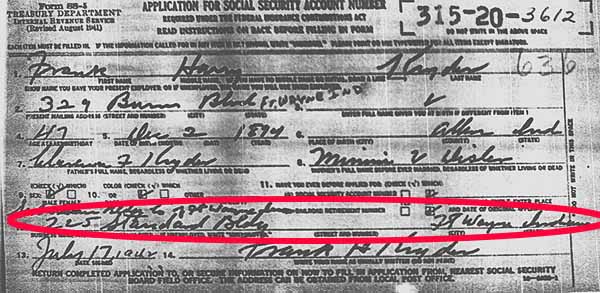

I retrieved Frank, Jr.'s Original Application. He applied 7/17/1942, at age 47, before going to Ypsilanti to work at The Hannan Company. Up until that time he lived on tax-free interest.

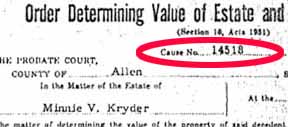

A rare state corporation in Indiana on the same day FEDERAL DEPOSIT INSURANCE CORPORATION , WASHINGTON, DC Status: Active : 7/17/1942 may be the reason Minnie Kryder's Estate is the FDIC Cert # 14518 in South Bend.

06/05/1920 Institution established. Original name: Valley Bank and Trust Company (FDIC#14518); now PNC South Bend Br (FWNB Cartel)

For the three hundredth time we see in 1942 his id 3612 is handwritten.

The end of the line for exchanging HOLC Bonds from Treasury Notes of 1948 was 1976.

So, who paid the tax for the 1976 redemption if none of the deceased Kryders, the registered owners could? The bonds had to be redeemed. They would no longer earn interest. They would look suspicious unclaimed.

In 2000 I received a formal Letter from The Social Security Administration stating that neither Clarence Frank nor Minnie V. Kryder ever made applications for taxpayer numbers.

Though Leonce Picot was in 1976 over-ensconced in his Panama Papers Idlewyld Mansion, and I knew he had worked for Roy C. Jones, Sr., I did not know Jones was working with Moser. Waynedale is bordered in Allen County by Old Bluffton Road which ran to the oil field in Bluffton, Wells County.

At last we get all these guys tied together with Dave Edgerton and his metallurgist Dad, and who pops up in the Numident SSN Files at the last hour? Clarence Frank Kryder, in whom God walked the earth.

Gg-father's Numident Trace is not a Death Record or SS5 and it reads:

Clarence Kryder Birth Date 31 Jul 1869 Birth Place Allen County, Indiana Claim Date 2 Dec 1948 SSN 315203611CYCLE DATE (YEAR) 1977 1977 CYCLE DATE (MONTH) 08 August CYCLE DATE (DAY) 05 5 05 Aug 1977

JONES MOVING Charter Number: X00027481 Status: Fictitious Active Entity Creation Date: 12/2/1948 State of Business.: MO Expiration Date: 8/28/2000 Owners Name: Address: 637 EAST 13TH STREET SEDALIA MO 65301 - (Jones for Loans was in MO early on)

(RAYTHEON COMPANY Officers 141 SPRING ST LEXINGTON, MA 02421 Jurisdiction H858850 WITHDRAWN (FOREIGN) 12/01/1948- 04/28/1998 DELAWARE 1201 PEACHTREE ST NE ATLANTA, GA 30361 FULTON)

HOLC was the lowest yielding investment of The Treasury, but supposedly the safest. December 2, 1948 was Frank, Jr's. birthday. Holders of HOLC bonds were offered Treasury notes of 1948 as an exchange. This was a good time to pay Frank, Jr. on his Kryder Company shares, with three beautiful daughters to put through college whose stepfathers by no means had the means to send them off so stylishly as they went.

Treasury Notes of 1948 were exchangeable for Treasury Notes of 1964 which chain ended in 1976. Frank was alive in 1964 to make any last exchanges, and Cousin Maxfield obtained his $8,000,000 NAVL bank loan June 1964. The Notes of 1964 were redeemed once and for all in 1976. In August 1977 Clarence Kryder's claim was entered, 27 years after his death.

"National Oil Indiana held title to land in Cedarville from 1948-1978. "

Perfect fit. Now to the larger conspiratorial aspects in consideration of the tax ids of all these related parties and their mysterious money.

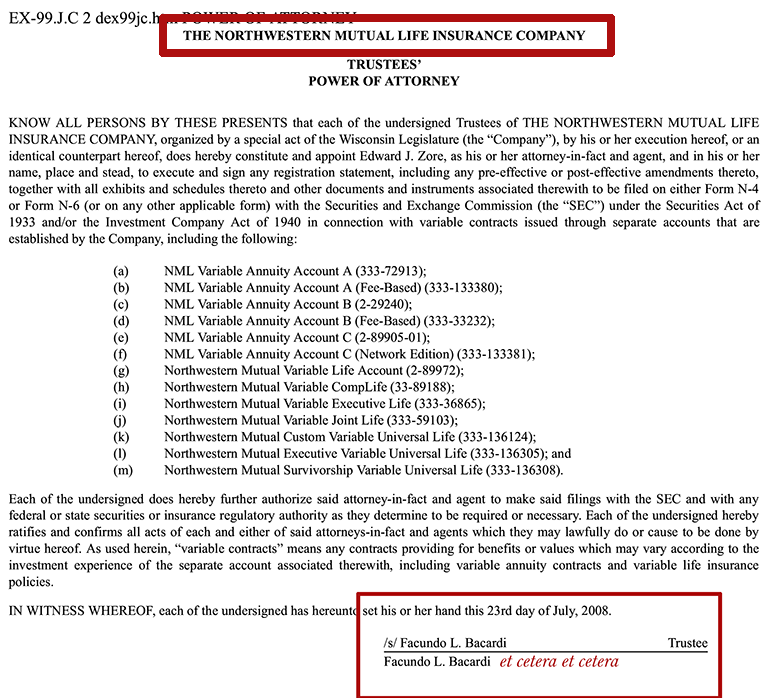

Below in front of our very eyes is the head and the tail. Alpha and Omega. This sequence is no accident. Bacardi's Federal Reserve id is used because Bacardi pays no tax in the U.S. though it bears the sacred F.R. Prefix of Continental Illinois Bank, Fort Wayne National Bank, et. al.- 109. And let us not forget, Barnett-Shoaffs of the Fort Wayne Bank Cartel employed Minnie and Frank Jr.'s estate lawyers.

As we construct additional taxpayer sequences of entities related through trusts and industry, observing more trends and sorting patterns with prefixes and suffixes, a logical explanation in the below Tax i.d. sequence is proposed that 36- prefixed with its relatives, is an ABA (American Bankers Assn) designation, Prefix No.36 being the Federal Reserve City of Saint Joseph, MO, Missouri being the G.H. WALKER state from the beginning of state filings. As well, it explains the meaning of The Saint Joe Company in Florida.

A TIN is a Texas Tax ID which is not the same as SSN, IRS, but with logical Texas corporate links, nonetheless de facto.

3603 Walt Disney Travel Co., Inc. (2007) IRS

3608 RESCON GROUP, LLC IRS (Texas 2004) TIN

3611 Clarence Frank Kryder, Sr.(claim 1948) SSN

3612 Frank Harry Kryder (SS5 1942) SSN

3613 Burger Chef Orlando (1969) IRS

3613 Ambassador Hotel PB LLC (2019) IRS

3614 St. Joe Natural Gas Company IRS

3617 Edgecot (Dave Edgerton- Leonce Picot, formed in CA but also in FL) IRS

3617 Gulf Pipeline Co. FL and TX IRS

3624 Pillsbury Charitable Foundation, KS ( Edgerton sold his Kendall Dade facilities assigned tax id 7617 to Pillsbury) IRS

3625 Trans-Canadian Oil LLC TX TIN (2021)

3631 Astec (Neuberger Berman subsidiary)

3632 Lockheed Martin Corporation (beryllium in FL)

3636 (Catco/Bush leases) Atlantic Richfield Company (Atlantic Refining) TIN (Texas Tax ID)

3639 Neuberger Berman; George Herbert Walker IV present President

3647 Midwest Natural Gas Pipeline Co. TIN (1996)

3643 M&J Lands (1959) Oviedo, FL IRS (William Moser & Roy C. Jones) Numident life claim

3648 Jones for Loans, Leonce Picot's employer before the Mai-Kai and associated advertising partner Picot-Jones IRS (Roy C. Jones, Sr.

3648 United Refining Company of Delaware (2022)

3666 UNOCAL EXPLORATION CORPORATION TIN (1990)

3652 Phelps Dodge Industries (1966)

3655 Crown Liquors LLC (2014) IRS

3668 Union Realty, Inc. ( FL, 1984) IRS

3674 PEPSI-COLA BOTTLING COMPANY OF DOTHAN, ALABAMA, INC

3674 Northwest Mutual Life REIT (held the Picot and Edgerton Life Insurance Policies, paid to an unauthorized trustee) IRS

3675 CROWN LIQUORS VII, LLC

3677 NABANCO MERCHANT SERVICES CORPORATION (Leonce Picot Florida Incorporator) TIN

3680 Canadian Oil, Inc. TX TIN 1987

3684 Bacardi F.R. RSSID (109) 3684

3684 Citizens & Southern Flori8da Corporation IRS 1985

3685 Pure-Tex Oil and Gas

3686 NATIONWIDE INSURANCE COMPANY OF FLORIDA (Ohio 1998)

3688 Barnett Chicago IRS

3688 American Sugar Company

3692 National Oil & Gas Exploration TX, IRS (1993) TIN

We're working up a string diagram at the Strawberry Patch, but here is some simple arithmetic to demonstrate things multiply as concealed money grows without division and transfer tax at death.

For simplicity, initials are assigned each id.

Here we see 37 ids and 31 unique ids. Edgecot and Gulf Pipeline share an id. Walt Disney Travel- WD 03 |

|

It's akin to a Birthday Party Game is it not? How could so many financially intimate associations have serialized taxpayer numbers which can be multiplied variously and work out to duplicate equivalencies? Not possible. This is taxpayer id manipulation for flagging and diversion of royalties and dividends to the unentitled and it has to come from inside the Treasury where numbers are assigned.

St. Joe Natural Gas, Bacardi, and National Oil all needed distilleries. Natural gas and booze were distilled in facilities which were interchangeable in times of war, for example.

Barnett Chicago represents the Fort Wayne intermarriages of Shoaff, Barnett, and Hall, wartime president of Lincoln National Life Insurance Company. Bank of America in Los Angeles sold the Continental IB stock to consumers then "acquired" Continental Illinois Bank, Chicago. This took place in the next generation following World War II industrialists. Heirs received their uncles' Continental Illinois Titles, historically deeded to Chicago Title and Trust Company, from Bank of America with no intermittent affiidavit. Because though the Trust Company kept its land titles in Contintental Illinois Bank, CT&T was owned by Lincoln National Life Insurance which later sold it to Bank of America after the acquisition.

Burger Chef was the Indiana split-off of Insta-burger/Burger King.